📘 Introduction: Understanding Price Inefficiency in Markets

Financial markets do not always move in a smooth and balanced manner. At times, price accelerates rapidly in one direction, leaving little opportunity for buyers and sellers to interact fairly. These sudden moves often confuse traders because traditional concepts like support, resistance, or indicators fail to explain what just happened.

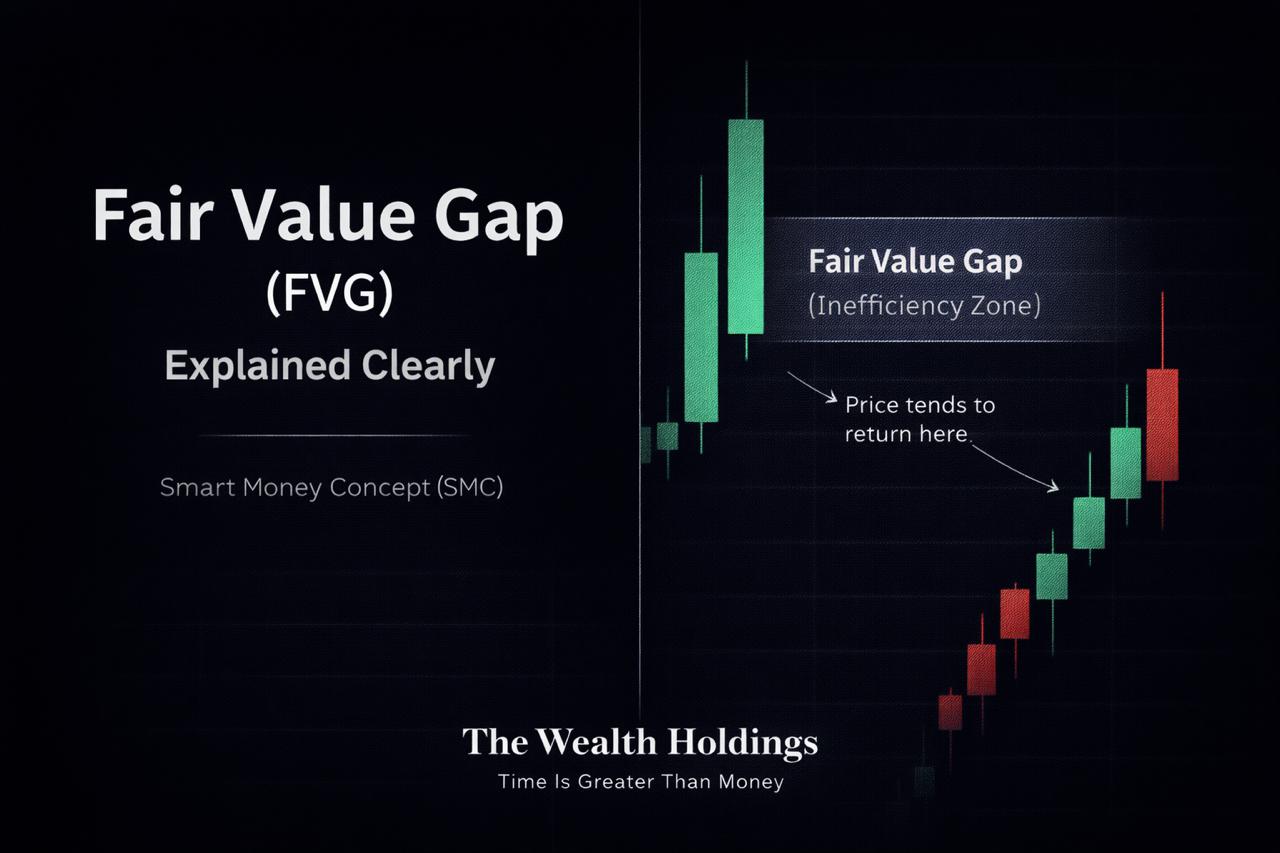

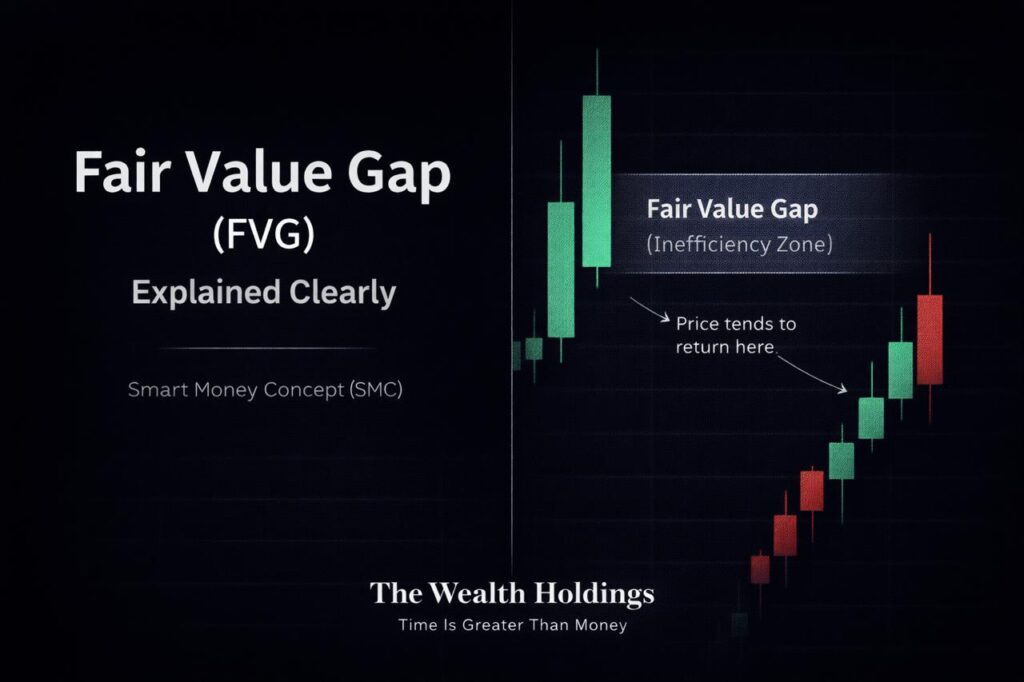

This behavior is explained by Fair Value Gaps (FVGs).

A Fair Value Gap represents price inefficiency, created when the market moves too quickly for balanced participation. Understanding FVGs helps traders explain why price moves aggressively, why it often retraces later, and how institutional order execution affects price delivery.

This article explains Fair Value Gaps from a market mechanics perspective, without strategies, signals, or trade recommendations.

With continued observation of fast-moving market phases, it becomes clearer that such price behavior is often easier to explain after the move than during its formation.

📊 What Is a Fair Value Gap (FVG)?

A Fair Value Gap is an area on the chart where price moves so aggressively that normal two-way trading does not occur. In simple terms, the market skips over prices instead of trading through them.

Technically, an FVG is identified using a three-candle structure:

- In a bullish move, the low of the third candle does not overlap with the high of the first candle.

- In a bearish move, the high of the third candle does not overlap with the low of the first candle.

This gap shows that price delivery was inefficient. It is not a support or resistance zone, but a sign that the market moved faster than fair participation allowed.

📉 Why Do Fair Value Gaps Form?

Fair Value Gaps form primarily due to institutional activity and urgency.

Large participants cannot always wait for perfect pricing. When execution becomes urgent, price is pushed aggressively to complete orders. This creates imbalance between demand and supply, resulting in gaps in price delivery.

Common reasons FVGs form include:

- Large institutional orders

- Sudden re-pricing of assets

- Strong momentum after consolidation

- Market reaction to new information

- Liquidity being consumed rapidly

Retail traders usually notice the move after it has already occurred, while the imbalance remains on the chart.

These moves often feel sudden in real time, highlighting how urgency in execution can override balanced participation.

Aggressive price movement that creates Fair Value Gaps is closely connected with market liquidity, which explains why price accelerates after orders are consumed.

https://thewealthholdings.in/understanding-market-liquidity/

🧩 Fair Value Gap vs Market Liquidity vs Market Structure

These three concepts are related but serve different purposes:

- Market Liquidity explains where orders are resting.

- Market Structure explains trend direction and reversals.

- Fair Value Gap explains how price moved inefficiently.

Liquidity answers where price is attracted.

Structure answers what direction the market is in.

FVG answers how aggressively price was delivered.

Confusing these concepts leads to misinterpretation. FVGs do not replace liquidity or structure — they complement them.

Fair Value Gaps should always be understood in the context of market structure, which explains how trends and reversals form over time.

https://thewealthholdings.in/market-structure-explained/

⚙️ Types of Fair Value Gaps

Fair Value Gaps can appear in different forms depending on market behavior.

Bullish Fair Value Gap

Created during strong upward price expansion, usually when buyers overwhelm sellers quickly.

Bearish Fair Value Gap

Created during strong downward moves, showing aggressive selling pressure.

Partial Fair Value Gap

When only part of the gap is revisited, indicating partial rebalancing.

Consecutive Fair Value Gaps

Multiple gaps formed in the same direction, often reflecting sustained institutional momentum.

Each type reflects price inefficiency, not certainty of future movement.

🔄 Why Does Price Often Return to Fair Value Gaps?

Markets naturally seek price efficiency over time.

Price may revisit a Fair Value Gap because:

- Some institutional orders remain unfilled

- Algorithms rebalance inefficient price delivery

- Volatility reduces and equilibrium is restored

- The market seeks fair participation levels

It is important to understand that price does not always return, but FVGs often act as reference areas where price interaction becomes more meaningful.

Rebalancing tends to become visible only after volatility slows, which is why these areas are often recognized in hindsight.

The tendency of price to rebalance inefficiencies also highlights why many traders struggle with consistency, which is explained in why most traders lose money in financial markets.

https://thewealthholdings.in/why-90-percent-traders-lose-money/

⚖️ Fair Value Gap vs Order Block

These two concepts are frequently confused.

- Fair Value Gap represents price imbalance.

- Order Block represents an area where institutions previously accumulated or distributed positions.

An Order Block shows where institutions entered.

An FVG shows how price moved aggressively away from that area.

When both align, the area gains contextual importance — but neither should be treated as a guaranteed trade level.

⚠️ Common Mistakes Traders Make With FVGs

Many traders misuse Fair Value Gaps due to lack of context.

Common mistakes include:

- Marking FVGs on every timeframe

- Treating FVGs as buy or sell signals

- Ignoring higher-timeframe structure

- Using FVGs without risk awareness

- Overloading charts with zones

Fair Value Gaps are analytical tools, not shortcuts to profitability.

Misusing Fair Value Gaps without context often leads to poor risk decisions, which connects directly with the importance of proper risk management in trading.

https://thewealthholdings.in/risk-management-in-trading/

🧠 How Professionals Interpret Fair Value Gaps

Professional traders use FVGs as part of a broader framework.

They:

- Start with higher-timeframe context

- Observe structure and liquidity first

- Use FVGs to understand price efficiency

- Focus on risk control rather than prediction

The purpose is clarity, not certainty.

🌍 Fair Value Gaps Across Different Markets

Fair Value Gaps are not limited to one asset class. They appear in:

- Crypto markets

- Indian equity indices

- Forex

- Commodities

They are a result of market mechanics, not manipulation or coincidence.

🎯 Final Thoughts: What Fair Value Gaps Really Represent

Fair Value Gaps represent moments when the market prioritized speed over balance. They explain why price sometimes moves aggressively and why it later seeks efficiency.

Understanding FVGs improves market awareness, not prediction accuracy. Traders who focus on understanding behavior rather than chasing outcomes develop stronger discipline over time.

In trading, context always matters more than speed.

Interpreting Fair Value Gaps improves understanding of market behavior, but clarity develops through observation rather than expectation.

📘 About The Wealth Holdings

The Wealth Holdings is a research-driven financial education platform focused on crypto markets, stock markets, commodities, and market psychology. Our goal is to help readers understand market behavior, risk awareness, and disciplined decision-making through structured educational content.

We do not provide trading signals, investment advice, or guaranteed outcomes. Our work encourages independent research, long-term thinking, and process-based learning.

Time Is Greater Than Money.

🌐 Visit: https://thewealthholdings.in

⚠️ Disclaimer

This content is for educational and informational purposes only and does not constitute financial or investment advice. Trading in financial markets involves risk, and readers should conduct their own research before making any financial decisions.

This is a very well-explained article on Fair Value Gaps. I liked how the concept was broken down logically instead of turning it into a trading signal. The explanation about price inefficiency makes the idea much clearer.