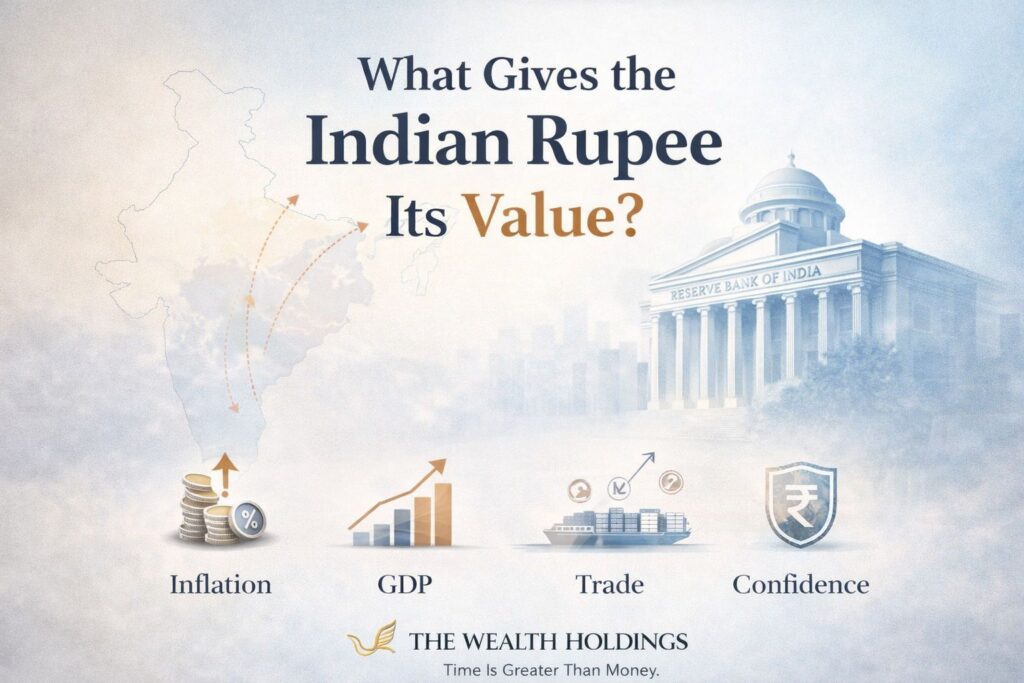

What Gives the Indian Rupee Its Value? Explained Simply

🧭 Introduction: Why Currency Value Matters Every day, we use money without questioning its value.We earn it, spend it, save it—but rarely stop to ask why a ₹100 note has meaning at all. The Indian Rupee does not have value because it is printed on paper.It has value because of trust, discipline, economic structure, and control. Understanding […]

What Gives the Indian Rupee Its Value? Explained Simply Read More »