🔹 Introduction

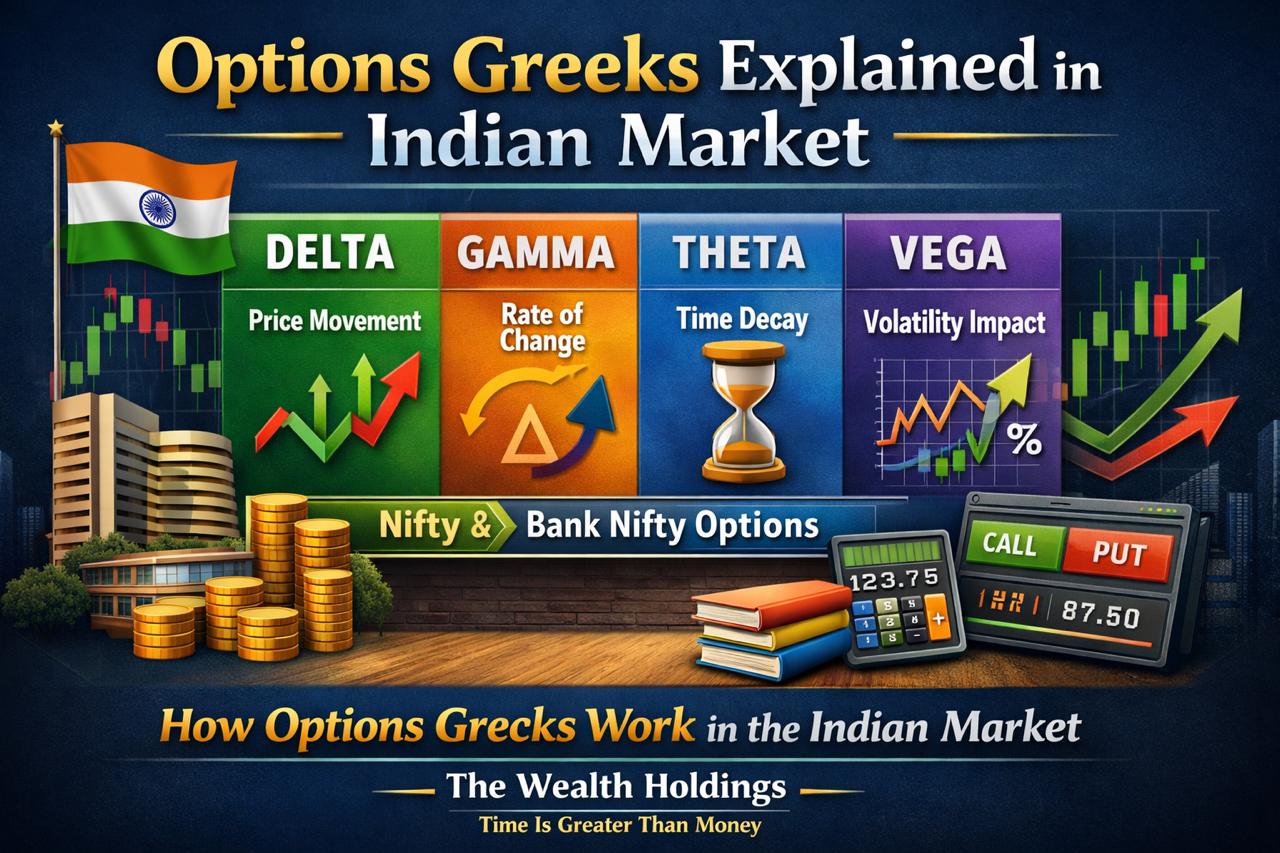

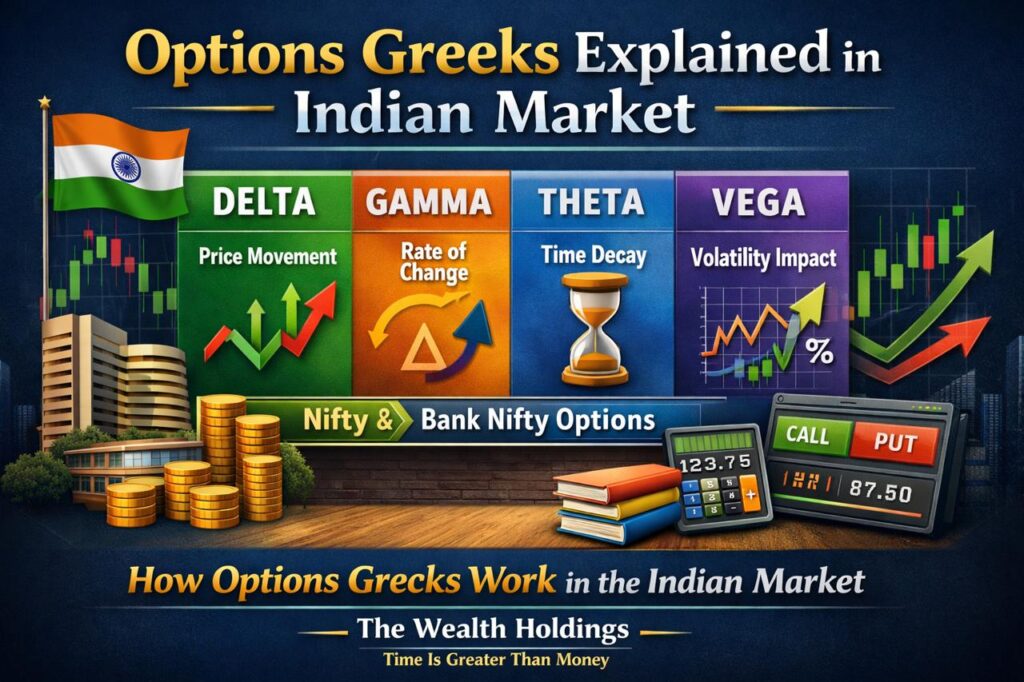

Options trading in the Indian market is often misunderstood. Many participants focus only on option prices without understanding why those prices change. In reality, option prices are influenced by multiple variables, and Options Greekshelp explain this behavior.

Options Greeks measure how sensitive an option’s price is to factors such as price movement, time decay, volatility, and interest rates. In the Indian market—especially in index options like NIFTY and BANK NIFTY—Greeks play a crucial role in understanding option behavior.

This article explains how Options Greeks work in the Indian market, what each Greek represents, and why understanding them is essential for structured market awareness.

Over time, observing Indian index options behavior across different market conditions makes it clear that price changes are often driven more by Greeks than by direction alone.

🔹 What Are Options Greeks? 📘

Options Greeks are risk metrics derived from option pricing models. They help quantify how an option’s price reacts to changes in different market variables.

In simple terms, Greeks answer questions like:

- How much will the option price change if the underlying moves?

- How does time affect option value?

- What happens when volatility changes?

The primary Greeks used in the Indian market are:

- Delta

- Gamma

- Theta

- Vega

- Rho

Each Greek focuses on a different dimension of risk.

These metrics become more meaningful with exposure to live market conditions rather than theoretical understanding alone.

🔹 Delta: Sensitivity to Price Movement 📈

Delta measures how much an option’s price is expected to change for a one-point move in the underlying asset.

In the Indian market:

- Call options have positive Delta

- Put options have negative Delta

- Delta ranges between 0 and 1 for calls, 0 and -1 for puts

For example, if a NIFTY call option has a Delta of 0.50, the option price may move approximately ₹0.50 for every 1-point move in NIFTY.

Delta also reflects directional exposure, making it one of the most observed Greeks.

Understanding option price behavior becomes easier when you also understand how market structure forms trends and reversals in financial markets.

https://thewealthholdings.in/market-structure-explained/

🔹 Gamma: Rate of Change of Delta ⚙️

Gamma measures how much Delta itself changes when the underlying price moves.

In the Indian market:

- Gamma is highest for at-the-money (ATM) options

- Near expiry, Gamma increases sharply

- Small price movements can cause large Delta changes

High Gamma means option behavior can shift rapidly, especially close to expiry. This explains why index options often show sudden sensitivity during expiry sessions.

This behavior is most visible during Indian index option expiry sessions, where small price changes can rapidly alter option sensitivity.

🔹 Theta: Impact of Time Decay ⏳

Theta measures how much an option’s value decreases with the passage of time, assuming all other factors remain constant.

Key observations in India:

- Theta accelerates as expiry approaches

- ATM and near-ATM options experience faster time decay

- Weekly index options show rapid Theta erosion

Time decay is unavoidable. Even if the market does not move, option value can decline simply due to time passing.

Understanding Theta helps explain why options lose value during sideways markets.

Time decay tends to be underestimated until traders observe how quickly option value erodes in low-movement or sideways conditions.

🔹 Vega: Sensitivity to Volatility 🌪️

Vega measures how much an option’s price changes with a 1% change in implied volatility (IV).

In the Indian market:

- Volatility rises during uncertainty (events, news, budget, global cues)

- Higher volatility increases option premiums

- Vega impact is higher for longer-duration options

Volatility-driven price changes often confuse traders who focus only on direction. Vega explains why option prices can rise or fall even without major price movement.

Volatility-driven option price changes are closely connected with market liquidity, which explains why prices move sharply during certain market phases.

https://thewealthholdings.in/understanding-market-liquidity/

🔹 Rho: Impact of Interest Rates 📉

Rho measures the sensitivity of an option’s price to changes in interest rates.

In India:

- Rho impact is relatively small

- Interest rate changes are less frequent

- Mostly relevant for long-dated options

While Rho is part of the Greek set, it is less influential compared to Delta, Gamma, Theta, and Vega in day-to-day Indian options trading.

🔹 How Greeks Interact With Each Other 🧠

Options Greeks do not work in isolation. They interact dynamically.

For example:

- A price move changes Delta, which affects Gamma

- Time decay reduces option value while volatility may offset it

- Near expiry, Theta and Gamma become more dominant

Understanding this interaction helps explain why option prices behave unpredictably during certain market phases.

In real market conditions, these interactions are rarely linear, which is why option pricing often feels unpredictable to participants.

🔹 Greeks and Market Conditions in India 🇮🇳

Different market environments impact Greeks differently:

- Trending markets: Delta dominates

- Sideways markets: Theta impact increases

- Volatile markets: Vega becomes significant

- Expiry days: Gamma sensitivity increases

This is why options behave differently on normal days versus expiry sessions.

🔹 Common Misconceptions About Options Greeks ❌

Some common misunderstandings include:

- Greeks predict price direction

- High Delta guarantees profit

- Time decay is always linear

- Volatility impact is constant

Greeks do not predict outcomes. They explain sensitivity and risk, not certainty.

Many traders misunderstand options behavior due to emotional decision-making, which is explained in detail through trading psychology and market behavior.

https://thewealthholdings.in/trading-psychology-emotions-financial-markets/

🔹 Why Understanding Greeks Matters 🧠

Options Greeks help traders:

- Understand price behavior logically

- Manage risk awareness

- Avoid emotional assumptions

- Interpret option movements objectively

They provide clarity, not shortcuts.

A clear understanding of options Greeks also supports better risk awareness, which is a core part of effective risk management in trading.

https://thewealthholdings.in/risk-management-in-trading/

🔹 Conclusion

Options Greeks form the foundation of understanding option price behavior in the Indian market. Delta, Gamma, Theta, Vega, and Rho each explain a specific risk dimension, and together they describe how option prices react to changing conditions.

Understanding Greeks does not guarantee profits, but it improves awareness, discipline, and decision-making. For anyone participating in Indian options markets, Greeks are not optional—they are essential.

A practical understanding of Greeks develops gradually through observation of how options respond to changing market conditions.

📘 About The Wealth Holdings

The Wealth Holdings is a research-driven financial education platform focused on crypto, stock markets, and market psychology. Our content is designed to help readers understand market behavior, risk awareness, and long-term decision-making through structured analysis and educational insights.

We do not provide trading signals, investment advice, or guaranteed outcomes. All content published on The Wealth Holdings is intended strictly for educational and informational purposes, encouraging independent research and disciplined thinking in financial markets.

Time Is Greater Than Money.

🌐 Visit: https://thewealthholdings.in

⚠️ Disclaimer

This content is for educational and informational purposes only and should not be considered financial or investment advice. Trading in options and financial markets involves significant risk, and readers should conduct their own research before making any financial decisions.

[…] Implied volatility directly connects with option sensitivity, which is explained in detail through how Options Greeks work in the Indian market.https://thewealthholdings.in/options-greeks-indian-market/ […]